workers comp settlement taxes

Cant Pay Unpaid Taxes. Workers compensation settlements are fully tax-exempt if paid under the Workers Compensation Act.

Is Workers Comp Taxable Gordon Gordon Law Firm

Wages and salary earned after returning to work with a partial disability and while still receiving benefits from workers comp or another program is fully taxable as income.

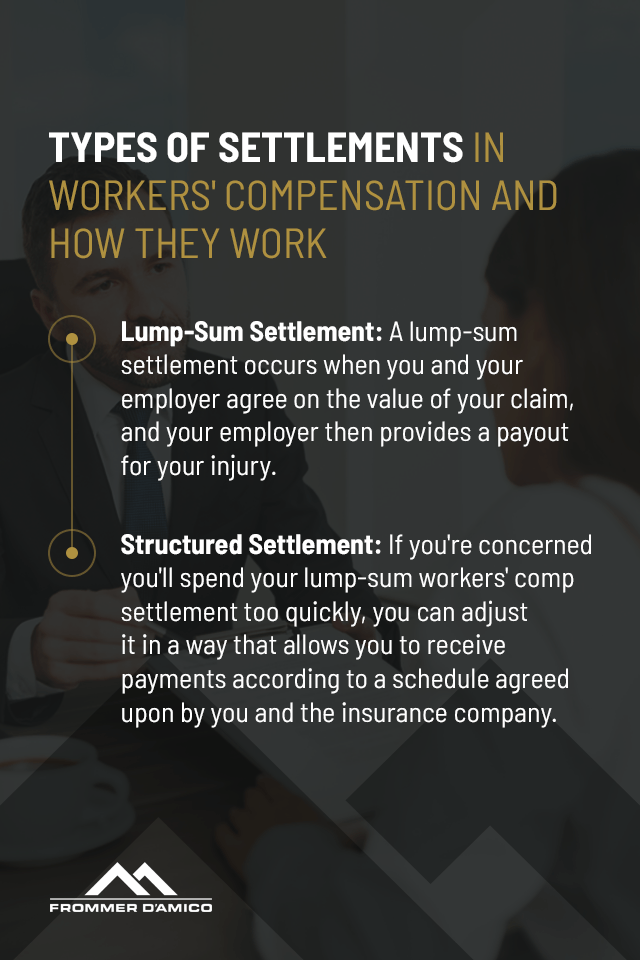

. The disadvantage is that once you agree to structured settlements it cant be changed to a lump sum without incurring penalties. Are Workers Compensation Benefits Taxable. According to the Internal Revenue Service IRS workers comp settlements under federal law do not qualify as taxable income for state or federal levels.

This principle also extends to any surviving family members if an employee dies. According to this IRS publication Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute. IRS Publication 907 reads as follows.

Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute in the nature of a workers compensation act. Workers compensation settlements are not taxed but if a lump sum is invested any earnings on that money are taxed. However there is one exception to workers compensation claims.

This includes lost wages compensation medical benefits and even survivor benefits paid to dependents. As long as its part of your workers comp benefits you wont get taxed. In some cases the Social Security Administration SSA may reduce a persons SSDI or SSI so.

Compensation from workers comp earned from occupational injuries or illnesses is fully tax-exempt provided the insurance carrier adheres to state workers compensation laws. However there is one exception. The lone exception arises when an individual also receives disability benefits through Social Security disability insurance SSDI or Supplemental Security Income SSI.

But like any tax situation there are exceptions to the rule you must know. Do i have to report my workers compensation settlement. Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law.

Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code IRC Section 61 that states all income is taxable from whatever source derived unless exempted by another section of the code. The answer is no.

Lump sum settlements from workers compensation cases do not count as taxable income either. However retirement plan benefits are taxable if either of these apply. In fact workers compensation settlements and payments are tax-exempt under the the Workers Compensation Act.

As a general rule workers compensation benefits are not taxable. According to Publication 907 Workers Compensation for an occupational sickness or injury if paid under a Workers Compensation act or similar law is exempt. Thus workers comp settlements are not taxable both at the state and federal level.

Do you claim workers comp on taxes the answer is no. This tax-free status applies to monthly benefits checks lump sum payments settlements and payments made to the surviving spouse or dependents of someone who died in a work-related incident. Ad Injury Settlement Calc by a Lawyer.

You retire due to your occupational sickness. This means you do not have to pay federal or state taxes on them. Workers compensation benefits are not normally considered taxable income at the state or federal level.

Generally you dont have to pay state or federal taxes on your workers compensation settlement or award. Usually workers compensation benefits will not affect your tax return. If youre injured at work and receive payments to cover your medical expenses loss of wages and painsuffering they arent taxable in most cases.

In general workers compensation benefits are NOT taxable both on the federal and state level. If you are also receiving Supplemental Security Income SSI or Social Security Disability Insurance SSDI benefits a portion of your workers. Possibly Settle For Less.

The one exception to this rule applies if youre also receiving benefits through Social Security Disability Insurance SSDI. Workers Compensation is in the same category of non taxable. In most cases they wont pay taxes on workers comp benefits.

But if on top of those youre also receiving Social Security Disability Benefits SSDI or Supplemental Security Income SSI you might be required to pay taxes on a portion. Workers compensation benefits do not qualify as taxable income at the state or federal level. As Workmans compensation is designed to provide for injuries and medical benefits when you are injured on the job the payments are not taxable income and not reported on your tax return although there are some exceptions.

Your workers comp settlement may still affect. Some Claims Worth 100s. No workers compensation benefits are not taxable income.

Is worker comp Settlement considered income. Get a Free Review. It falls into the same category as personal injury settlements or awards meaning that the payment is considered a compensation for money you have lost as a result of an accident or illness.

Workers Compensation Claims. June 4 2019 713 PM. Tax Implications of Settlements and Judgments.

IRC Section 104 provides an exclusion from taxable income with. But that doesnt mean youll be free from taxes if youre on workers comp. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

The answer to your question is no. It doesnt matter whether youre receiving monthly payments or a lump sum settlement. Under the Virginia Workers Compensation Act your workers compensation benefits are fully exempt from state and federal taxes.

The quick answer is that generally workers compensation benefits are not taxable. When injured workers collect workers compensation benefits due to an accident or injury they wont have to worry about taxes either. Generally speaking no workers comp settlements are not taxable at the federal or state level.

Ad Tax Relief up to 96 Free Consult Get Your Qualification Options Now. The following payments are not taxable. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

No workers compensation benefits are not taxable.

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Is Workers Comp Taxable In Nj Craig Altman

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Is Workers Comp Taxable Gordon Gordon Law Firm

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Pin On Michigan Workers Compensation Attorneys

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Do I Have To Pay Taxes On My Workers Comp Benefits

While There Is Not A Specific Average Workers Comp Settlement For A Wrist Injury Most Insurance Companies Will Pay Several Ye Worker Injury Finding A New Job

Workers Compensation Attorney Los Angeles Workers Compensation Lawyer Workers Compensation Insurance Work Injury Workplace Injury

Are Workers Compensation Settlements Taxable

Many Of Our Clients Want To Retire While On Workers Comp Benefits This Is A Natural Reaction Because Illness Or Injury Worker Take Money Retirement Benefits

What Wages Are Subject To Workers Comp Hourly Inc

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Michigan Lawyer Explains How Workers Comp Is Not A Fringe Benefit And How Employees Hurt On The Job Can Have Legal Rights In 2022 Fringe Benefits Worker Compensation

Is Workers Comp Taxable Workers Comp Taxes

Can You Collect Social Security Disability And Workers Comp At The Same Time R Social Security Disability Social Security Disability Benefits Social Security