working two jobs at the same time tax

Week1 pay 250 tax allowance 212 38 taxable 760 tax deducted. You may need to fill out this portion of the form if you have multiple jobs or are married and both you and your spouse work.

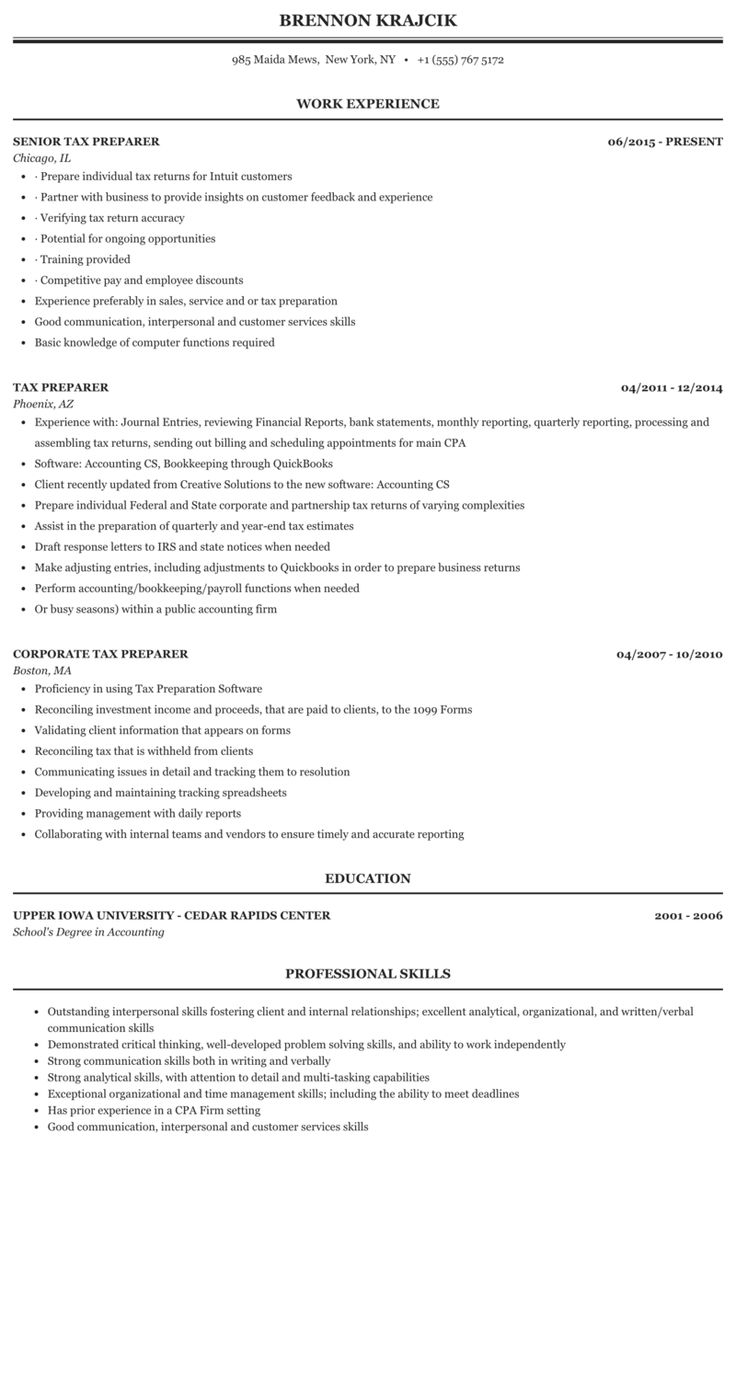

67 Elegant Gallery Of Sample Resume Sas Experience Check More At Https Www Ourpetscrawley Com 67 Elegant Gallery Of Sample Resume Sas Experience

Other tax changes may likewise apply.

. But knowing the ins and outs of paying your taxes when you have 2 or more jobs can save you an incredibly unpleasant surprise come tax time. We will send an updated Tax Credit Certificate to you. Does having multiple jobs affect your return.

Income Tax on second jobs. If youre working youre entitled to earn a certain amount of money without paying Income Tax. The monthly Personal Tax Allowance 202122 set at 104750 wont be taxed at all whilst the remaining 15250 will be taxed at 20 or 3050.

No tax due as the 2 months pay are less than the tax allowance but 760 has already been. While this may not affect you this year it. If you are paid 150 per week in your first job and 100 per week in your second job.

I am curious how am I supposed to file my taxes since one is a standard job and the other I work as an independent contractor. The Pay As You Earn PAYE system treats one job as your main employment. Also if you did not have.

Actually any income you earned could affect your refund or balance due amount on your tax return. In so many words you really dont want to get caught. You may even be obliged to make quarterly installments.

Secondly to claim the benefits of PF contribution with two or more companies you will have to share the same UAN number with the other company also where in they can record the contribution. If you get the Earned Income Credit a second job may make you ineligible for the advantage. Jobs should not conflict because I work from home and I am on the bench with Company A.

What to do if you get a second job. If youre a salaried employee for all of your jobs meaning you receive a T4 Statement of Remuneration for each one you could be in for an unexpectedly large tax bill next spring. The IRS taxes individuals based on the amount of income earned so if you earn more money you could be pushed into a higher tax bracket and have to pay more taxes on what youve made.

You only get one Personal Allowance so its usually best to have it applied to the job paying you the most. This will depend on how much youre paid for each position. In the event that you get a second job and increment your pay it could change your tax section.

The IRS Withholding Calculator can help them navigate the complexities of multiple employer tax situations and. What forms would I fill out how do I fill out the W4 what other things should I be aware about etc. Meanwhile the full 600 from your second job is taxed at 20 or 12000 leaving you with a bill of 15050.

Yes when you have multiple employers in a year then you must report all the W-2s you receive on one tax return. Two EarnersMultiple Jobs Worksheet. However if your first position falls below your personal allowance your second job tax will generally be set at the standard 20.

If youve already been working two jobs and have yet to file your 2017 return youll find that. Your current employment contract might restrict you from certain types of work and youll need to consider such factors. No tax will be paid on the first position as it is under your personal allowance but the second job.

IR-2018-124 May 24 2018. This can occur if a stay-at-home life partner returns to work also. About a year later a study showed that people working from home are having sex taking naps dating shopping online and doing side hustles on company time.

If in addition to your two jobs for which you receive a W2 you may consider freelancing to earn even more income then you will likely have to pay taxes on this income. Around 50 of the respondents to the. How would I go about working two jobs at the same time.

The second page of the IRS Form W-4 contains a Two-EarnersMultiple Jobs Worksheet. If youre serious about juggling two full-time jobs this means you cant phone it. 250 150 400 tax allowance 212 212 424.

If you work in two or more jobs at the same time you can divide your tax credits and rate band between jobs. Whether you choose to work two full-time jobs out of necessity or just because your career interests are diverse consider the legal implications of potentially doubling your income before you commit to spending 16 hours working each day. If you work in the same state as your employer your income tax situation probably wont change.

WASHINGTON The Internal Revenue Service urges two-income families and those who work multiple jobs to complete a paycheck checkup to verify they are having the right amount of tax withheld from their paychecks. Even though both employers. I just recently started the office job and plan to start working as a driver in the next few days.

Hence both the companies can extend you the benefits of PF but on the same PF account. Company A pays Salary on W2 with appropriate taxes taken out Company B pays hourly on W2 with taxes taken out also. You should speak to an accountant.

Revenue will give your tax credits and rate band to that job. In such case there cannot be two registrations that can be done. If you have not already e-filed your return then take the following steps to add multiple W-2s.

Do I fill out a W2 form yearly with the total. Ideally you should save up to 30 of your freelancing income to fulfill your tax obligations. You can enter many W-2s into TurboTax.

I have a standard office job and I am looking to Uber at the same time. Week 2 pay 150. However the following are the most common working remotely tax implications to know about.

But if you start working remotely full-time across state lines you may have to file and pay tax in two states. This is called the Personal Allowance and is 12570 for the 202223 tax year. It goes into effect for the 2018 tax year.

100 Free Download Multi Captcha Typing Software Tested And Updated And Working Online Data Entry Jobs Online Data Entry Online Teaching Jobs

Resume Templates Multiple Jobs Same Company 3 Templates Example Templates Example Job Resume Examples Resume Templates Resume

43 Resume Tax Accountant Images Tax Accountant Accounting Jobs Resume

The Pros And Cons Of Freelancing Admin Jobs Graduate Recruitment Interview Skills

Pin By Linda Ghazi On Education Cover Letter For Internship Writing A Cover Letter Introduction Letter For Job

6 Tips For Filing Taxes With Multiple Jobs Filing Taxes Finance Saving Extra Jobs

Top Paying Side Jobs Infographic Side Jobs Work From Home Careers Social Media Infographic

How Many Words Cover Letter Surat Pengantar Belajar Bahasa Inggris

Quickbooks Self Employed Review 2022 Carefulcents Com Quickbooks Quarterly Taxes Small Business Accounting

Sales Job Description Sales Job Description Job Description Template Sales Resume Examples

43 Resume Tax Accountant Images Tax Accountant Accounting Jobs Resume

Bahasa Beasiswa Inggris Contoh Surat Dalam Contoh Dan Benar Lamaran Kerja Baik Yang 10 Surat Lengkap Surat Pengantar Belajar Bahasa Inggris

Nomisma The Finest Software For Income Tax Computation Accounting Jobs Accounting Software Pinterest For Business

Free Download 60 Entry Level Hr Resume Sample Free For Hr Generalist Cover Letter Template In 2022 Surat Pengantar Belajar Bahasa Inggris

The Breathtaking Orginal Eleanor Darragh Birth Cert Within Sample Certificate Regarding Certificate Of Word Template Letter Templates Business Letter Template

An Audit Resume Is Quite Important To Learn As You Are About To Apply For Job To Be An Auditor Here You Do Not Need To Be Worried Since You Can Just

65 Beautiful Photos Of Sample Resume For Computer Science Teacher In India Surat Pengantar Belajar Bahasa Inggris